Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs instructions?

IRS instructions are detailed instructions provided by the Internal Revenue Service (IRS) for taxpayers to use when preparing their federal income tax returns. They provide guidance on how to complete and submit a tax return, including the forms and schedules that need to be completed and the information that needs to be included. The IRS also provides instructions for other tax-related topics such as deductions, credits, and other special tax situations.

What is the purpose of irs instructions?

IRS instructions provide guidance for taxpayers on how to complete and file federal tax forms. They explain the law and provide steps to follow to correctly complete each form. They also include information on filing requirements, deadlines, and other important rules related to filing taxes.

What information must be reported on irs instructions?

The IRS instructions require you to provide information such as your name, address, Social Security number, filing status, income, deductions, and credits. You must also provide information related to any other tax forms you are filing, such as estimated tax payments and tax payments made with your return. Additionally, you must report any other information related to your taxes, such as any additional taxes owed or refunds received.

When is the deadline to file irs instructions in 2023?

The deadline to file IRS instructions in 2023 is April 15th, 2023.

What is the penalty for the late filing of irs instructions?

The penalty for late filing of IRS instructions depends on several factors, including the amount of taxes owed and the reason for the late filing. Generally, the penalty for filing late is 5% of the amount of taxes owed for every month or part of a month the return is late, up to a maximum of 25%. If the return is more than 60 days late, the minimum penalty is the smaller of $135 or 100% of the amount of taxes due.

Who is required to file irs instructions?

Individuals and businesses who meet certain criteria are required to file IRS instructions. This includes:

1. Individual taxpayers who earn above a certain income threshold, depending on their filing status and age.

2. Self-employed individuals and independent contractors who have net earnings over a certain amount.

3. Corporations, partnerships, and LLCs (Limited Liability Companies) that meet the filing requirements based on their business structure and income.

4. Non-profit organizations that generate taxable income.

5. Estates and trusts that receive income or have a certain value of assets.

6. Certain foreign individuals or entities who have income from U.S. sources.

7. Individuals who want to claim certain credits or deductions, even if they are not required to file.

It's important to consult the specific IRS instructions and guidelines or seek professional advice to determine if you are required to file.

How to fill out irs instructions?

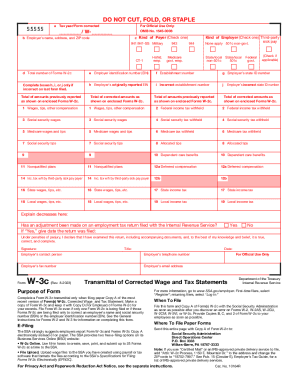

To fill out IRS instructions, follow these steps:

1. Read through the instructions thoroughly: Start by reading through the instructions provided by the IRS for the specific form you need to fill out. Make sure you understand all the requirements and guidelines mentioned.

2. Gather necessary information: Collect all the required information and documents before you begin filling out the form. This may include your Social Security number, W-2 forms, financial statements, receipts, or any other relevant information.

3. Use black or blue ink: When filling out the form, use black or blue ink to ensure clarity and legibility. Avoid pencil or any other color.

4. Follow the provided guidelines: The instructions typically provide step-by-step guidance on each section of the form. Follow these guidelines carefully to avoid errors or omissions.

5. Provide accurate information: Be precise and accurate when entering information. Double-check that all entries are spelled correctly and match the corresponding documentation.

6. Complete all necessary sections: Fill out all the required sections of the form accurately. Leave no section blank if it applies to your situation. If a section is not applicable, mark it as such or write "N/A."

7. Use proper formatting: Follow the formatting instructions provided in the IRS instructions. This may include using certain codes, abbreviations, or specific numeric formats.

8. Seek help if needed: If you have any questions or doubts while filling out the form, consult the IRS instructions, IRS website, or consider seeking assistance from a tax professional or a qualified tax preparer.

9. Review and verify: Once you have completed the form, review all the information you have entered to ensure its accuracy and completeness. Errors or inaccuracies may lead to delays or penalties.

10. Sign and date the form: Sign and date the form as required. Some forms may require additional signatures from other parties, so make sure to follow the instructions.

11. Keep a copy for your records: Make a copy of the completed form and any supporting documentation for your records before submitting it to the IRS.

Note: It is always recommended to consult the specific instructions provided by the IRS for the form you need to fill out, as each form may have specific requirements and guidelines.

How can I send instructions w2 for eSignature?

To distribute your w 2 instructions form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit w2 correction straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit instructions w2.

How do I complete w2 codes on an Android device?

On Android, use the pdfFiller mobile app to finish your w2 instructions form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.